prince william county real estate tax assessment

Enter street name without street direction NSEW or suffix StDrAvetc. The tax rate is expressed in dollars per one hundred dollars of assessed value.

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

The property tax calculation in Prince William County is generally based on market value.

. Prince William County collects on average 09 of a propertys assessed fair market value as property tax. Prince William County Virginia Home. The Assessments Office mailed the 2022 assessment notices beginning March 14 2022.

Submit Business Tangible Property Return. Supervisors reduced the real estate tax rate in the current fiscal year from 1125 per 100 of assessed value to 1115 but homeowners still saw an average increase of. Prince William County - Log in.

Appealing your property tax appraisal. Submit Daily Rental Return. The real estate tax is paid in two annual installments as shown on the tax calendar.

By creating an account you will have access to balance and account information notifications etc. For example if the total tax rate were 12075 per 100 of assessed value then a property with an assessed value of 300000 dollars is calculated as. The county proposes a new 4 meals tax to be charged at restaurants.

Submit Transient Occupancy Return. If you have questions about this site please email the Real Estate Assessments Office. Request a Filing Extension.

Enter jurisdiction code 1036. The system will verbally provide you with a receipt number for you to write down. Click here to register for an account or here to login if you already have an account.

Report a Vehicle SoldMovedDisposed. Checking the Prince William County. Enter the house or property number.

Ad Property Taxes Info. Prince William County VA currently has 479 tax liens available as of April 27. Advance payments are held as a credit on your real estate personal property or business tax account and applied to a future tax bill when the tax rate and assessment are set or when you file your business tax return.

Press 1 to pay Personal Property Tax. To make matters worse for residential property owners property tax bills. 300000 100 x 12075 362250.

Use both House Number and House Number High fields when searching for range of house numbers. Prince William County accepts advance payments from individuals and businesses. The county assessed home.

Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. The average yearly property tax paid by Prince William County residents amounts to about 32 of their. Press 2 to pay Real Estate Tax.

The average homeowner will pay about 250 more in Real Estate taxes and fire levy taxes next year. The Prince William County Assessor is responsible for appraising real estate and assessing a property tax on properties located in Prince William County Virginia. Prince William County has one of the highest median property taxes in the United States and is ranked 120th of the 3143 counties in order of median property taxes.

Daily Rental Tax Heavy Equipment Rental Business 15 of the gross proceeds arising from rental of heavy equipment property. Submit Business License Return. This estimation determines how much youll pay.

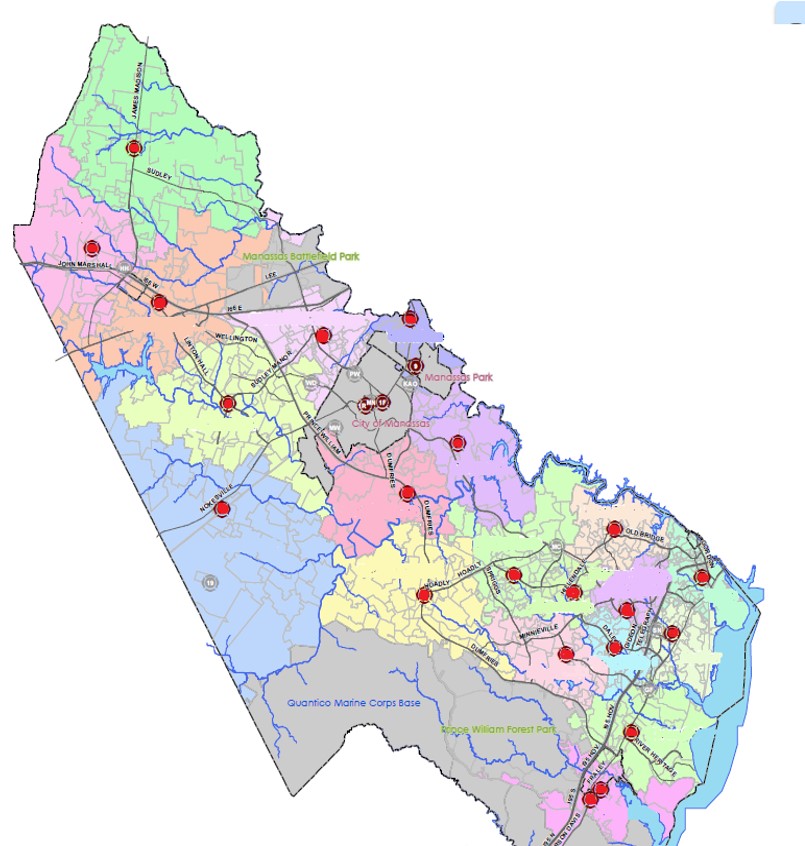

Transient Occupancy Tax 8 of total charge for lodging or space furnished to a transient. All real property in Prince William County except public service properties operating railroads interstate pipelines and public utilities is assessed annually by the Real Estate Assessments Office. Market value is the probable amount that the property would sell for if exposed to the market for a reasonable period with informed buyers and sellers acting without undue pressure.

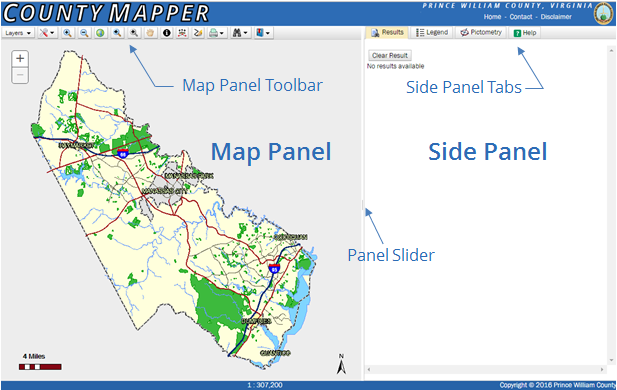

They are a valuable tool for the real estate industry offering. The Prince William County Tax Assessor is the local official who is responsible for assessing the taxable value of all properties within Prince William County and may establish the amount of tax due on that property based on the fair market value appraisal. You may view the 2022 assessments via the online Real Estate Property Assessment System.

Report High Mileage for a Vehicle. You can contact the Prince William County Assessor for. Submit Consumption Tax Return.

Enter the Account Number listed on the billing statement. Enter your payment card information. Discover the Registered Owner Estimated Land Value Mortgage Information.

In Prince William County Virginia the tax rate is 105 which is substantially above the state average. Submit Consumer Utility Return. You can pay a bill without logging in using this screen.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Prince William County VA at tax lien auctions or online distressed asset sales. Dial 1-888-2PAY TAX 1-888-272-9829. Information on your propertys tax assessment.

When tax assessors estimate the value of your property they multiply that number by the tax rate of the county. They are maintained by various government offices in Prince William County Virginia State and at the Federal level. Daily Rental Tax Short Term Rental Business 1 of the gross proceeds arising from rental of tangible personal property.

These buyers bid for an interest rate on the taxes owed and the right. The Prince William County assessors office can help you with many of your property tax related issues including. Reporting upgrades or improvements.

Prince William Prosecutors Seek More County Funding Headlines Insidenova Com

Prince William County Warranty Deed Form Virginia Deeds Com

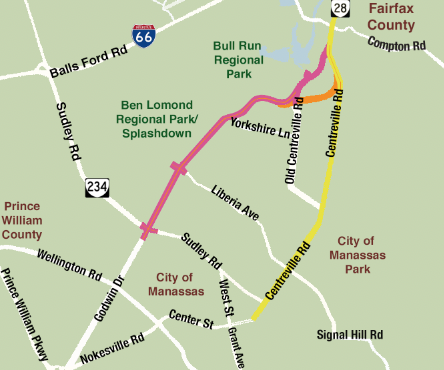

Prince William Area Leaders Call For Reconsideration Of Route 28 Bypass Headlines Insidenova Com

Prince William Supervisors Set To Approve Tax Hikes For Residents Restaurant Customers Tuesday

Gop Prince William Supervisors Criticize Tax Increase Headlines Insidenova Com

Class Specifications Sorted By Classtitle Ascending Prince William County

Acting County Executive Proposes The Fiscal Year 2023 Budget Prince William Living

Prince William Wants To Hike Property Taxes Introduces Meals Tax

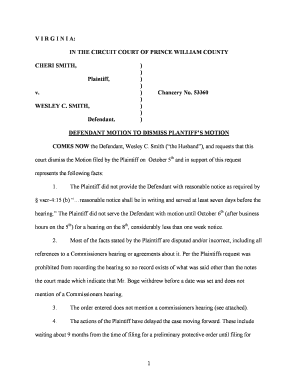

Fillable Online Liamsdad V I R G I N I A In The Circuit Court Of Prince William County Cheri Smith Plaintiff V Liamsdad Fax Email Print Pdffiller

The Rural Area In Prince William County

First Half Of 2020 Real Estate Taxes Due July 15 Prince William Living

Data Center Opportunity Zone Overlay District Comprehensive Review